Investment Management

Offering a range of different strategies to meet varying client needs.

Tavistock Asset Management manages a range of diversified, multi-asset mandates with clear objectives, clear risk levels and broad exposures to underlying investment expertise across the market.

Each mandate is managed for clients by professional investment managers and there is a full range of risk profiles, different levels of active management and a choice of portfolio structures.

We work with you to find the most suitable option for your client, allowing you to spend more time planning your clients’ future whilst benefitting from our specialist investment expertise and analysis.

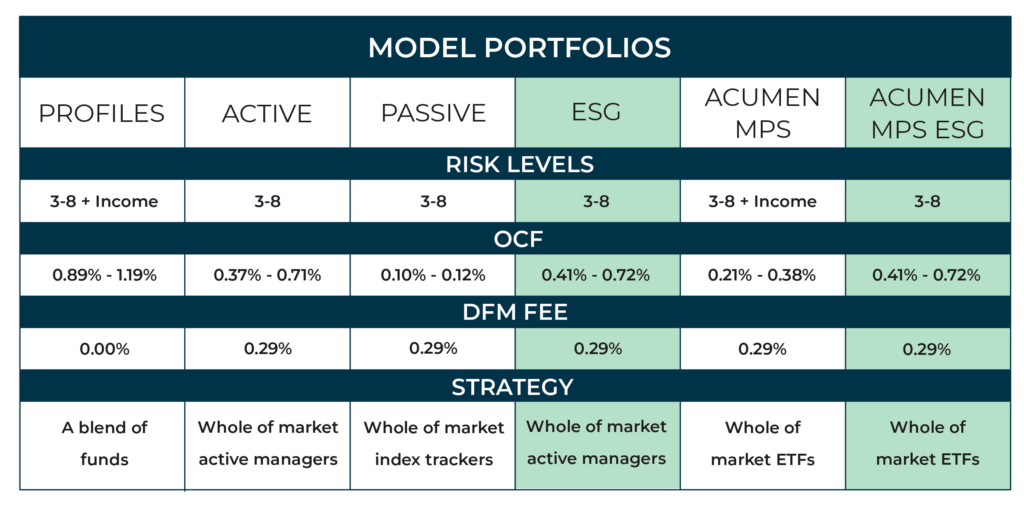

The mandates currently available are outlined in the table below.

Factsheets and literature

For the latest Tavistock Asset Management factsheets and literature click below:

Latest Insights

Financial resilience during divorce: Managing costs and securing your future

Divorce is a challenging experience, both emotionally and financially. Beyond the personal toll, the financial implications of divorce can be significant, requiring individuals to rethink their long-term plans and take steps to secure their financial future. While separation brings about complex emotional decisions, it also presents the need for careful financial planning to ensure resilience during and after divorce.

Finding midlife balance

Midlife is often described as a time of transition. For many, this phase comes with a unique set of challenges: balancing family responsibilities, maintaining retirement savings, and pursuing personal goals. While it can feel overwhelming, a clear plan can help you manage competing priorities and stay on track for a secure financial future.

Time for a financial spring clean? Here’s where to start

Spring is a natural time for a reset — and that applies to your finances just as much as your home. Taking a little time now to get organised can help you feel more in control, reduce unnecessary costs, and make sure your plans still reflect what matters most to you.